Value of Ending Inventory Using Variable Costing

Marginal costing doesnt take fixed costs into account under product costing or inventory valuation Inventory Valuation Inventory Valuation Methods refers to the methodology LIFO FIFO or a weighted average used to value the companys inventories which has an impact on the cost of goods sold as well as ending inventory and thus has a financial impact on the companys. Therefore the ending balance of the raw materials is at 29000.

Ending Inventory Formula Step By Step Calculation Examples

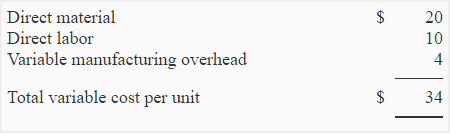

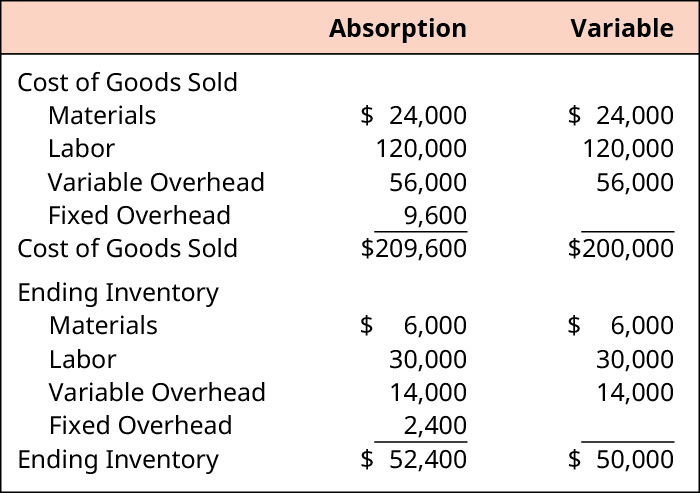

Income determined with absorption costing will equal income determined with direct costing.

. Ending work in process inventory will increase. A business cannot produce finished goods or marketable goods if it does not have an inventory of raw materials to. From the beginning finished goods inventory then.

Companies that use absorption costing will have a balance sheet with a higher ending inventory. If the ending inventory costs are going up or are likely to increase LIFO costing approach may be better as the higher cost units the ones purchased or made last are accounted to be sold. By assets one can know both liabilities and shareholders equity as the source of fund can be equity or finance.

The raw materials form a critical part of any manufacturing business as it is the starting input for initiating production. Equivalent Value 25000 0 5000 100. Historical costing is a method of accounting that measures the value of an asset based on its original cost when purchased or.

Accounting TermsAccounting DictionaryAccounting Glossary Largest Online Accounting Dictionary - Over 4200 Accounting Terms. The fixed costs are usually allocated to units of output on the basis of direct. Ending finished goods inventory will decrease.

Importance of Raw Material Inventory. Whether you are an analyst business person or accounting student audit the records of a corporation a business manager or balance your own checkbook you will find the VentureLine accounting dictionary of accounting terms of. Income determined with absorption costing will be lower than income determined with direct costing.

Equivalent Value 29900 The components of enterprise value are Equity value total debt preferred stock minority interest cash and cash equivalentsValue of a company can be measured from its own assets. What Is A Fixed Cost And How Do I Determine It. However the expenses on their income statement will be lower.

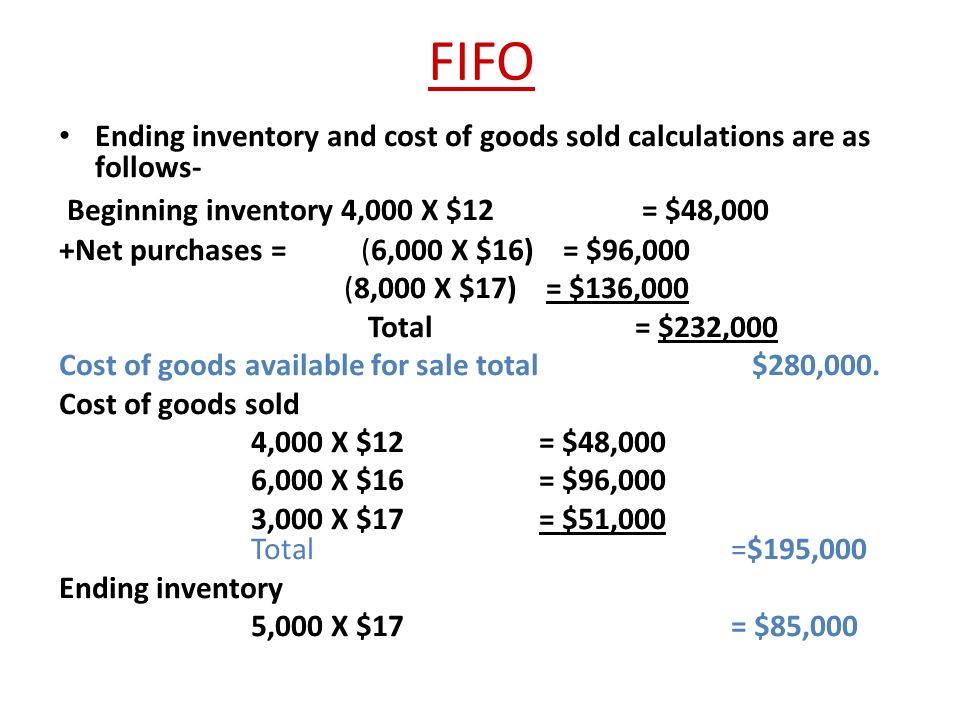

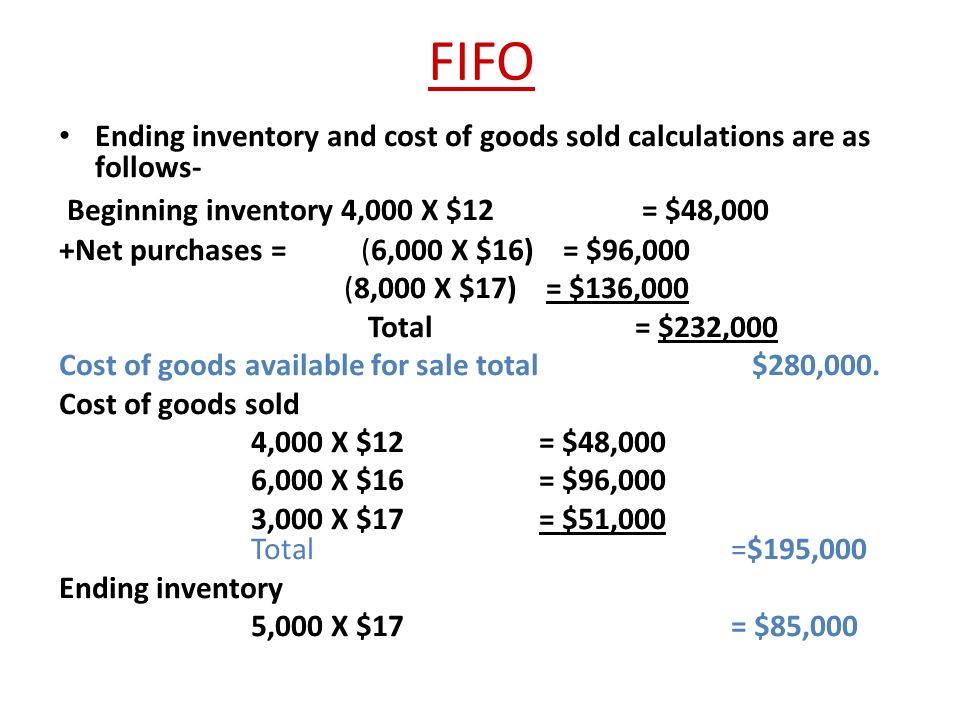

In cost management an approach to inventory valuation in which variable costs and a portion of fixed costs are assigned to each unit of production. So to assess the relative value of last-in-first-out lifo or first-in-first-out fifo ending inventory cost you simply have to look at the way your inventory costs are changing.

How To Calculate Ending Inventory Using Absorption Costing Online Accounting

6 3 Comparing Absorption And Variable Costing Managerial Accounting

Exercise 4 Variable And Absorption Costing Ending Inventory External Reports Accounting For Management

Compare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

No comments for "Value of Ending Inventory Using Variable Costing"

Post a Comment